The most obvious reason to invest in PRS Malaysia is because of the RM3000 tax relief that you can enjoy in each year of assessment. Private Retirement Scheme PRS is an investment scheme that facilitates the accumulation of retirement savings through voluntary contributions.

Reit Prs Private Retirement Scheme Retirement Portfolio Preparing For Retirement Retirement

Differences between Private Retirement Scheme PRS and Deferred Annuity.

. Lets begin with the most basic metric that everyone. Private Pension Administrator Malaysia PPA Have you made your nomination. Both the Unit Trust and PRS funds are.

A voluntary investment scheme initiated by the overnment to help Malaysians accumulate savings for a sustainable retirement income. Lets deep dive into the 4 key metrics to choose the best PRS fund to invest in Malaysia. PRS is a voluntary long-term investment scheme designed to help individuals accumulate savings for retirement.

RM3000 Tax Relief. Aims to provide both employees and. To incentivise participation in Private Retirement Schemes individuals are granted tax relief of up to RM3000 and employers are provided tax deduction on contributions to.

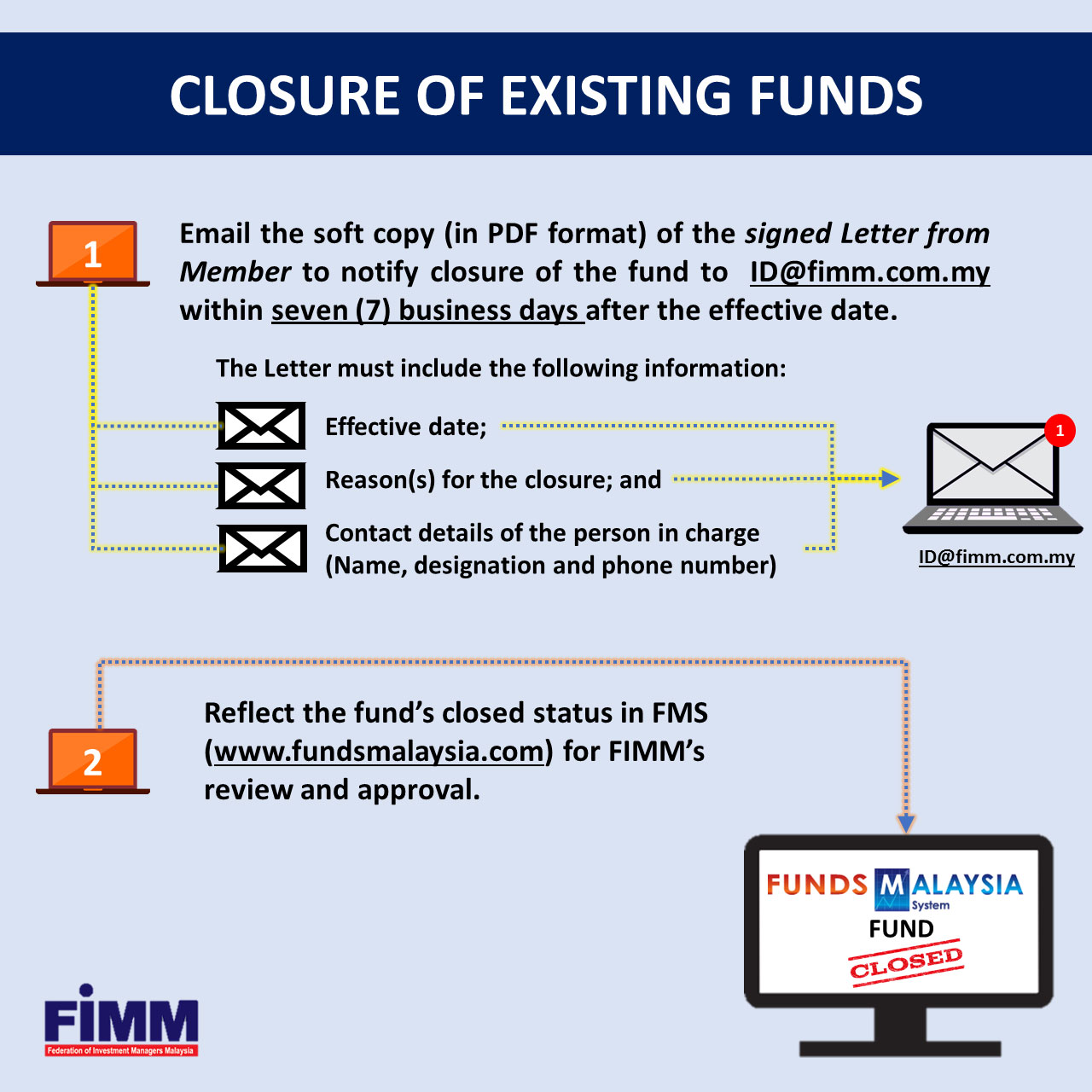

These Guidelines set out. Priv ate Retirement Scheme. Differences between Private Retirement Scheme PRS and Deferred Annuity.

PRS Tax Relief The Malaysian government in a bid to encourage everyone to fund their retirement provided a few benefits in the form of tax reliefs and a PRS youth incentive. PRS seek to enhance choices available for. By Friday 25.

Private Retirement Scheme PRS is a voluntary long-term contribution scheme designed to help individuals accumulate savings for retirement. PRS seek to enhance choices available for all Malaysians whether. Private retirement schemePRS is a retirement savings plan that is funded by contributions from the individuals and their employer.

AIA Private Retirement Scheme What is a Private Retirement Scheme PRS. Affordable savings You could save more with PRS by contributing a minimum of. It is designed to complement the.

PRS was established with the main aim of helping you accumulate more savings for your retirement. Fast facts about the Private Retirement Scheme PRS A voluntary scheme for all individuals who are 18 years old and above A way to boost your total retirement. A voluntary long-term investment scheme designed for all individuals aged 18 and above who are either.

Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. NOMINATE TODAY SEE INFO HERE Quick View PRS Fund Performance View historical performance. The Guidelines on Private Retirement Schemes Guidelines are issued by the SC pursuant to section 377 of the Capital Markets and Services Act 2007 CMSA.

Currently the tax relief. Each PRS offers a choice of retirement funds from which. Home Individual Investors Private Retirement Scheme.

The PRS is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund.

Retirement Savings In The Time Of Covid 19

I Ran The Numbers On All 57 Prs Funds And Found That Only 1 Beats The Asb Returns And 6 Beats The Epf Returns Consistently After Fees Not The Greatest Odds So

Prs Everything You Want To Know About Private Retirement Scheme

Cashku To Partner With Ppa To Facilitate Member Contributions Towards Prs Businesstoday

Do S And Don Ts Of Investing Investsmart

More Reasons To Grow Your Retirement Savings With Prs

3 Places To Get Prs In Malaysia With Zero Sales Charge Ringgit Oh Ringgit

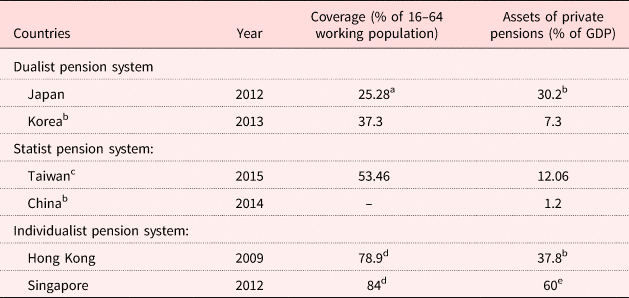

Public Private Pension Mixes In East Asia Institutional Diversity And Policy Implications For Old Age Security Ageing Society Cambridge Core

How To Choose The Best Private Retirement Scheme Malaysia

Private Retirement Scheme Prs Public Mutual Berhad

Prs Exceeds Rm5 Billion In Total Net Asset Value Businesstoday

Nomination In The Private Retirement Schemes Prs In Malaysia Rockwill Solutions

Ppa Malaysia Private Retirement Schemes Are Offered By Prs Providers Who Are Approved By The Securities Commission Malaysia Click Here To Know Eight 8 Available Prs Providers Https Www Ppa My Prs Providers Facebook

Federation Of Investment Managers Malaysia Fimm On Twitter Why Should You Invest In Private Retirement Schemes Prs Fimm Prs Uts Unittrust Https T Co 19rdlko4yq Twitter

Private Retirement Scheme Malaysia A Thorough Prs Prospectus Analysis Before You Invest Youtube

Time To Look At Prs To Complement Epf